Why Auto Insurance Rates Go Up

Understanding why auto insurance rates go up can help you find the best coverage. Some estimates show prices rose 9% in 2022 and may increase another 7% in 2023. Below, you can learn car insurance savings tips, reasons why auto insurance rates are increasing, and factors that affect rates.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

UPDATED: Sep 19, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Sep 19, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

- The economy is the biggest factor that affects auto insurance rates

- Other reasons why your car insurance rates go up are driving history and credit rating

- Take advantage of auto insurance discounts to lower your rates

There are various reasons why auto insurance rates go up, such as driving violations, new or increased coverages, or more claims in your area. In addition, estimates predict auto insurance prices to go up by 7% this year.

Keep reading to learn more about the many factors that affect auto insurance rates and understand why insurance rates are increasing.

How the Economy Affects Auto Insurance Rates

One of the biggest factors driving these price spikes is the current economy.

Basically, when the economy is doing well, people tend to spend more money on things like cars, travel, and luxuries they wouldn’t typically buy. As a result, there are more cars on the road, more people traveling, and more potential for accidents and claims. Insurance companies are well aware of this and often raise rates to account for the increased risk.

Additionally, people tend to have more disposable income when the economy is doing well, leading to higher demand for car insurance. Insurance companies know people are willing to pay more for coverage, so they may raise rates to capitalize on this.

However, as the economy struggles amid inflation following the pandemic, insurance companies also face a decline in profits and are struggling to cover their expenses, one of the many reasons auto insurance rates are rising.

Understanding how auto insurance companies calculate your rates is important when looking for auto insurance coverage. Let’s take a look at some of those factors.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

How Your Driving History Affects Auto Insurance Rates

Auto insurance companies will always review your driving record when calculating your rates. Having tickets, accidents, and DUIs on your record are common factors that affect auto insurance rates. Keeping your record clean and being a safe driver can help you keep your auto insurance rates low.

Learn how to find the best car insurance for high-risk car insurance.

How Getting a Ticket Affects Auto Insurance Rates

Traffic tickets can be a real pain, not only because of the fines and potential legal consequences but also because they can cause your car insurance rates to go up. Essentially, when you get a traffic citation, it’s like a red flag to insurance companies that you may be at a higher risk to insure. Follow our advice on fighting a speeding ticket.

Here’s a look at how getting a ticket can affect your auto insurance rates:

| Insurance Company | Rates With a Ticket | Rates With a Clean Record |

|---|---|---|

| Allstate | $188 | $160 |

| American Family | $136 | $117 |

| Farmers | $173 | $139 |

| Geico | $106 | $80 |

| Liberty Mutual | $212 | $174 |

| Nationwide | $137 | $115 |

| Progressive | $140 | $105 |

| State Farm | $96 | $86 |

| Travelers | $134 | $99 |

| U.S. Average | $147 | $119 |

Think of it this way — imagine you’re a car insurance company, and you’re trying to predict how likely a person is to get into an accident. One of the things you might look at is their driving history. If someone has a lot of traffic violations, it stands to reason that they may be more likely to get into an accident than someone who has a clean driving record.

So, when you get a traffic ticket, it can cause your car insurance rates to go up because the insurance company may see you as a higher risk to insure.

The good news is that the effect of a moving violation on your insurance rates will typically decrease over time as long as you don’t get any more citations.

Different types of traffic violations will have different levels of impact on your insurance rates. For example, a speeding ticket may cause your rates to go up less than a ticket for reckless driving. However, a DUI can cause your rates to go up significantly. Find out what happens if you get a DUI and learn what you should know about your first DUI offense.

But also remember that different insurance companies have various policies when it comes to how they handle traffic violations, so it’s always a good idea to shop around for insurance quotes.

FreeAdvice.com makes it easy to compare several insurance providers near you. These online comparison quotes are free and don’t require private information like social security numbers.

Online quotes are a great way to see how moving violations will affect your rates. For example, if you have one speeding ticket, you can put that information in when obtaining your free quotes. This way, you can see how much each provider charges for your specific driving record.

How At-Fault Accidents Affect Auto Insurance Rates

Another factor that can send your insurance rates soaring is being found at fault in an accident. Your state auto accident laws will determine when drivers are at-fault.

Accidents of any kind are a major pain and usually a financial burden due to all the damage and potential injuries they cause. If you need to file a claim with your insurance provider, there is a good chance you will see an increase in your rates. Usually, that increase won’t be too drastic.

On the other hand, if you are found to be at fault for an accident, your car insurance rates are likely to skyrocket. When you have an at-fault accident on your record, it’s a big red flag to insurance companies that you may be a higher risk to insure.

Here is the average cost of car insurance after an at-fault accident:

| Insurance Company | Rates With an Accident | Rates With a Clean Record |

|---|---|---|

| Allstate | $225 | $160 |

| American Family | $176 | $117 |

| Farmers | $198 | $139 |

| Geico | $132 | $80 |

| Liberty Mutual | $234 | $174 |

| Nationwide | $161 | $115 |

| Progressive | $186 | $105 |

| State Farm | $102 | $86 |

| Travelers | $139 | $99 |

| U.S. Average | $173 | $119 |

Let’s use an analogy to help explain this. Imagine you’re a car insurance company, and you’re trying to predict how likely a person is to get into an accident. One of the things you might look at is their accident history.

If someone has been involved in multiple accidents and found to be at fault, the odds show they’re more likely to cause an accident again.

There’s no way around it: drivers with accidents on their record — especially at-fault accidents — look a lot worse than someone with a clean accident history.

So, when you’re found to be at fault for an accident, it can cause your car insurance rates to climb because the insurance company sees you as a higher risk to insure. The good news is that the effect of an at-fault accident on your insurance rates will typically decrease over time as long as you don’t get into more crashes.

Being at fault in an accident can also lead to legal consequences, fines, and criminal charges. These types of accidents make you responsible for damage and injuries caused and can have long-term negative effects. Learn when to hire a car accident lawyer after an accident.

How Credit Score Affects Auto Insurance Rates

Here’s another reason your car insurance rates increase — your credit score.

This number representing your creditworthiness can affect car insurance rates a lot more than many realize. Your credit score plays a big role in determining how much you pay for car insurance coverage.

Here’s how it works — when you apply for car insurance, the insurance company will look at various factors to determine how much of a risk you are to insure. One of the things they’ll look at is your credit score.

If you have a lower credit score, the insurance company may see you as a higher risk to insure. So, this might be a reason why your car insurance rates go up.

Here is how credit score affects car insurance rates:

| Insurance Company | Rates With Poor Credit | Rates With Fair Credit | Rates With Good Credit |

|---|---|---|---|

| Allstate | $296 | $197 | $176 |

| American Family | $203 | $136 | $116 |

| Farmers | $269 | $160 | $140 |

| Geico | $240 | $155 | $125 |

| Liberty Mutual | $355 | $226 | $177 |

| Nationwide | $250 | $162 | $142 |

| Progressive | $270 | $170 | $130 |

| State Farm | $220 | $145 | $115 |

| Travelers | $265 | $165 | $135 |

| U.S. Average | $226 | $148 | $123 |

It’s worth noting that not all insurance companies use credit scores to determine rates. In some states, providers aren’t allowed to base rates on the quality of your credit.

If you’re shopping for car insurance and want to know if a company uses credit scores in its rating process, you can ask them or check their website. Also, FreeAdvice.com provides company comparisons based on these rules and what rates to expect with various credit scores.

Now, if you have a low credit score, don’t panic. There are things you can do to improve your credit score and lower your insurance rates. Paying your bills on time, keeping your credit card balances low, and disputing any errors on your credit report are all ways to improve your credit score.

How a Lapse in Coverage Affects Auto Insurance Rates

Additionally, a coverage lapse also affects auto insurance rates. A lapse in coverage can be a real problem because it leaves you uninsured and can be why your car insurance rates go up.

Essentially, when there’s a gap in your coverage, it tells insurance companies you may be at a higher risk to insure.

Imagine you’re a car insurance company, and you’re trying to predict how likely a person is to follow the law and make their payments on time. One of the things you would look at is their insurance history. If someone has gaps in their coverage, it shows they are more likely to drive without insurance or forget to pay their bills.

So, when you have a lapse in your coverage, it can cause your car insurance rates to increase because the insurance company sees you as a higher risk to insure. The good news is that the effect of a lapse in coverage on your insurance rates will typically fade over time if you maintain continuous insurance coverage.

How to Keep Your Auto Insurance Rates Low

Are you now feeling like your car insurance rates will break the bank? Don’t lose hope. While certain factors can cause rate spikes, there are also things you can do to bring them down. Here are some of the ways to mitigate rate increases and keep your insurance costs low.

Know How Much Coverage You Need

Are you now feeling the unavoidable pain of high car insurance rates? Well, the last and longest-standing factor that can drive those rates up are the coverages you have. For example, you’ll pay higher rates for full coverage auto insurance than you would for liability coverage.

Maintain Continous Auto Insurance Coverage

Regarding car insurance, the length and consistency of your coverage is the “frequent flyer” program for your car insurance rates. The longer you have been insured with a company or have maintained continuous coverage, the more “points” you earn and the more likely you are to qualify for discounts.

So, you get rewarded if you’re a loyal customer with a long record of continuous coverage. Most insurance companies offer discounts for customers who have been with them for a certain length of time and for those who have maintained continuous coverage.

The longer you have been insured, the more likely you will get low-cost car insurance with discounts. So, if you haven’t already, shop around for insurance quotes at FreeAdvice.com and maintain continuous coverage with a top provider so you can enjoy the benefit of lower rates in the future.

Discounts Help Keep Auto Insurance Rates Low

The best auto insurance companies offer various discounts to help drivers save.

Read More:

- Best Pay in Full Car Insurance Discounts

- Best Car and Home Insurance Discounts

- Best New Vehicle Car Insurance Discounts

- Best Multi Vehicle Car Insurance Discounts

- Best Loyalty Car Insurance Discounts

- Best Home State Car Insurance Discounts

In addition, some insurance companies offer discounts for save driving. Avoid distractions while driving, obey traffic laws, and be aware of your surroundings to stay safe on the road and reduce your risk of accidents and claims.

Compare Rates from Multiple Auto Insurance Companies

Shop around for the best rates. Insurance quotes vary greatly from company to company, so it’s important to shop around and compare multiple insurers. Take the time to research the best auto insurance companies that sell online and compare their rates and coverage options to find the best cost for your specific needs and budget.

FreeAdvice.com makes it easy to compare rates from top providers in your area. It’s free, and there are no strings attached.

Install Telematics and Safety Devices

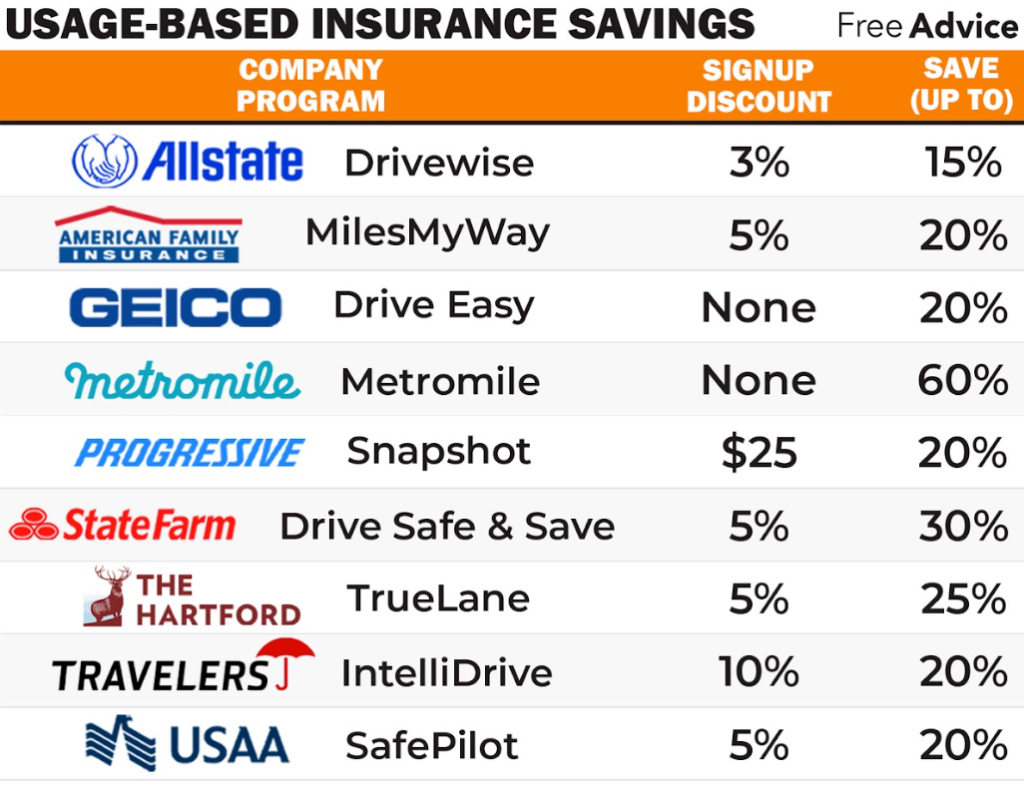

You should consider getting telematics insurance coverage to save on auto insurance. Telematics insurance, or usage-based insurance, tracks your driving and awards a discount based on how well you do.

In addition, install a GPS tracking device in your car, or you can sign up for anti-theft programs with your insurer. These types of devices will help you track your car’s location and reduce the risk of theft.

Keep An Eye On Your Budget

Finally, adjust your budget. Knowing that insurance rates are going to increase, you can start to adjust your budget and make room for the extra expenses. You can start by cutting unnecessary costs and saving more money.

Case Studies: Factors Influencing Auto Insurance Rate Increases

Case Study 1: The Economy’s Impact on Auto Insurance Rates

Progressive Insurance Company is one of the leading auto insurance providers in the market. They company noticed a significant increase in auto insurance rates this year. One of the primary factors driving these rate hikes is the state of the economy. When the economy is thriving, people tend to spend more on cars and luxury items, resulting in more vehicles on the road and an increased risk of accidents.

Insurance companies, including Progressive Insurance Company, raise rates to compensate for the higher likelihood of claims. Additionally, during economic booms, consumers often have more disposable income, leading to higher demand for insurance coverage, which can also drive rates up.

Case Study 2: Impact of Driving History on Auto Insurance Rates

Geico Insurance Agency specializes in offering auto insurance coverage. The company analyzes various factors when determining rates for their customers. One critical factor is the applicant’s driving history. Drivers with a clean record, free of tickets, accidents, and DUIs, are typically considered low-risk and are rewarded with lower insurance rates.

However, individuals with a history of traffic violations or at-fault accidents are perceived as higher-risk drivers. Insurance companies, like Geico Insurance Agency, increase rates for such individuals to offset the likelihood of future claims. It’s essential for drivers to maintain a safe driving record to keep their auto insurance rates low.

Case Study 3: The Role of Credit Score in Auto Insurance Rates

State Farm Insurance is known for its auto insurance offerings. They consider various factors when determining premiums, including the applicant’s credit score. A lower credit score is seen as an indication of higher financial risk and may lead to increased insurance rates. Insurance companies, like State Farm, rely on credit scores to assess an individual’s likelihood of filing claims or missing payments.

Improving one’s credit score by paying bills on time, reducing credit card balances, and disputing any errors on credit reports can help lower auto insurance rates. It’s crucial for individuals to be aware of the impact their credit score can have on their insurance premiums.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Why Car Insurance Rates Can Go Up: The Bottom Line

As you can see, there are many reasons why your car insurance rates go up. Still, inflation, higher manufacturing costs, and the overall state of our economy are reasons auto insurance rates are rising today.

Car insurance rates are influenced by various factors, but by practicing safe driving habits, maintaining a good credit score, and keeping your coverage continuous, you can help keep your costs low. Remember to shop around for the best deals, and always be aware of the current economy, as it can greatly affect your auto insurance rates. In addition, knowing how much insurance coverage you need is key to finding affordable insurance premiums.

Frequently Asked Questions

Why did my insurance go up for no reason?

Though you may have not made any policy changes, factors such as inflation, credit score, and driving history could be why your car insurance rates are rising.

Why is my car insurance so high with a clean record?

As explained, various factors outside of your control impact your rates, including location and vehicle type.

Why does my car insurance go up every 6 months?

Generally, insurance companies renew your policy every six months, where they reassess your risk to insure. Of course, factors that may cause your rates to go up at renewal include traffic violations, claims, and address changes.

How much has auto insurance gone up?

Some estimates show that auto insurance rates rose about 9% in 2022 and are expected to go up another 7% in 2023.

What are the factors that affect auto insurance rates?

Along with the economy, other factors that affect auto insurance rates are your driving history, credit score, location, gender, and age. Always compare average auto insurance rates by age and gender from the best companies for the cheapest policy.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.