Full Coverage Auto Insurance (2024)

Full coverage auto insurance rates are an average of $132 per month. However, full coverage quotes will vary by state, driving profile, and demographics, so the best way to find affordable full coverage auto insurance is to compare rates from different companies like Geico, State Farm, and Travelers.

Free Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

UPDATED: Oct 4, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.

UPDATED: Oct 4, 2023

It’s all about you. We want to help you make the right legal decisions.

We strive to help you make confident insurance and legal decisions. Finding trusted and reliable insurance quotes and legal advice should be easy. This doesn’t influence our content. Our opinions are our own.

On This Page

- Full coverage auto insurance coverage consists of liability, collision, and comprehensive auto insurance

- If you finance a vehicle, you must get full coverage auto insurance

- Full coverage auto insurance costs $132/mo on average, but you can get lower full coverage auto insurance rates with discounts

Full coverage auto insurance includes liability, collision, and comprehensive auto insurance coverage in one policy. Your auto insurance rates will be more expensive than if you carry only what’s required based on your state’s minimum liability requirements, but you’ll have extra coverage for your vehicle.

Even though full coverage auto insurance quotes cost more, you can lower prices through discounts and other factors that determine auto insurance.

Get a quick look at affordable full coverage auto insurance in your local area by entering your ZIP code in the FREE online comparison tool. For more details about full coverage auto insurance quotes, continue reading.

Full Coverage Auto Insurance Explained

Full coverage auto insurance consists of liability, collision, and comprehensive insurance coverages in a single policy. So, what does auto insurance cover? Auto insurance protects you when you get into an accident with someone else.

However, collision and comprehensive coverage help with damages to your vehicle regardless of whether you’re at fault.

Read on to learn more about cheap full coverage auto insurance options in the industry.

Liability Auto Insurance

The best auto insurance for full coverage includes liability auto insurance since most states require this coverage. Assume you’re driving down the road and accidentally rear-ended another vehicle. The other driver and their passengers have been injured, and their vehicle has been severely damaged.

Who will pay for their medical bills and car repairs? This is where liability insurance comes in. It is intended to protect you financially if you are found to be at fault in an accident and pays for bodily injury and property damage where you’re at fault in an accident. It’s made up of two or more coverages, such as:

- Bodily injury liability

- Property damage liability

- Uninsured/underinsured motorist coverage (UM/UMM)

- Personal injury protection (PIP)

- Medical payments (MedPay)

Requirements vary by state, but bodily injury and property damage liability are always part of liability coverage. Any added coverages that are required shouldn’t affect your annual rates, such as personal injury protection or medical payments.

Learn more: Personal Injury Protection (PIP) and Medical Coverage That Your Auto Insurance Policy Will Pay For

If UM/UMM, PIP, and MedPay aren’t part of your state’s requirements, you may pay extra for them.

Collision Auto Insurance

When you want extra coverage for your vehicle regardless of fault, you should get collision auto insurance. If you get into an accident, your auto insurance company will help you with the cost of repairs. Your auto insurance company will also compensate you so you can get another vehicle if the accident results in a total loss.

For example, imagine driving down the road when, out of nowhere, another driver runs a red light and crashes into your car. The damage to your vehicle is extensive, and you’re now wondering who will pay for the repairs. That’s where collision coverage comes in. It pays for the damages to your car regardless of who is at fault in the accident.

Brandon Frady Licensed Insurance Agent

Collision coverage is also useful when renting a car because it covers damage to the rental car in the event of an accident. Even if you were the one who caused the accident, your collision coverage will kick in and help cover paying for those damages.

Having collision coverage provides you with peace of mind in case something goes wrong. It’s similar to having a financial safety net for your car. It is an essential component of a comprehensive policy that will provide you with the necessary roadside protection. So, if you have a new vehicle, full coverage auto insurance costs may be worth it.

Comprehensive Auto Insurance

For accidents that don’t involve colliding with another vehicle or object, you’ll need comprehensive auto insurance. Comprehensive coverage pays for damage related to vehicle theft, fire, storms, falling objects, and other accidents that don’t involve a collision. So, you can count on full coverage auto insurance when bad weather causes a car accident.

It is important to note that comprehensive coverage does not cover damages resulting from a collision or accident with another vehicle. This is where collision coverage comes into play. Although comprehensive and collision coverage are frequently sold together as part of a full coverage policy, they are very distinct types of coverage.

Suppose your car is parked on the sidewalk, and a tree falls on it during a storm. Your comprehensive policy would cover payments to fix the damage the tree caused. And, if your car is stolen, comprehensive coverage will aid you in covering the cost of replacing it.

It’s like adding another layer of protection to your vehicle, and it’s a great way to ensure that you’re fully protected when something goes wrong in an unexpected event.

Special Auto Insurance Coverages

Each full coverage auto insurance company carries special auto insurance coverages. Here are three you may recognize:

- Roadside assistance

- Rental auto insurance and collision damage waiver (CDW)

- Travel insurance

Sometimes roadside assistance comes as a perk when you purchase auto insurance. However, rental reimbursement may be one you have to ask for when you buy full coverage auto insurance.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Full Coverage Limits and Deductibles

Coverage limits are the maximum amount of money an insurance company will pay out when there’s a claim filed. If the coverage limits are too low, they may not cover the full extent of damages or injuries sustained in an accident, leaving you, the policyholder, to pay the remaining costs out of pocket. Understanding your coverage limits will help you figure out if they will be enough to protect you in the event of an accident.

Meanwhile, your deductible is the amount of money you have to pay out of pocket before the insurance company starts to cover the costs of a claim. A higher deductible will result in a lower premium, but it will also require you to pay more out of pocket before your coverage begins.

Understanding your full coverage insurance coverage limits and deductibles can assist you in making informed policy decisions and ensuring that you have the appropriate level of protection and financial coverage in the event of something going wrong.

There are also coverage requirements in certain scenarios. For example, if you are financing a vehicle, you must, at the very least, maintain full coverage insurance. Full coverage insurance is optional if you own your own car, especially if it is worth more than $4,000. It’s optional but still strongly recommended.

Keep in mind, even though the word “full” is in this coverage type’s name, full coverage does not cover everything. Things it won’t cover include liability, uninsured motorists, medical expenses, personal injury protection, towing and labor, rental car reimbursement, customized parts, or gap insurance. If you need more protection for your car or yourself beyond full coverage, you can always buy more insurance to add to your existing policy.

Deciding Whether Full Coverage Is Worth It

So, what is the answer to how much insurance coverage you need? If you’re financing your vehicle, you’ll need full coverage auto insurance. While full coverage auto insurance quotes are more expensive than liability insurance, you’ll have full protection for your vehicle.

Full coverage auto insurance rates are more expensive than liability-only insurance, but the benefits of full coverage auto insurance are great, ensuring your vehicle gets paid for if you get into an accident.

Full Coverage Auto Insurance Rates

Full coverage auto insurance rates average $119 in the United States, but you might be wondering what full coverage auto insurance costs are in your state.

We did some digging and found a complete list of full coverage auto insurance rates by state. Compare full coverage auto insurance in the data below. Use the search box to search for a state quickly:

| State | Monthly Rates |

|---|---|

| Idaho | $59 |

| Maine | $60 |

| Iowa | $60 |

| Wisconsin | $62 |

| Indiana | $64 |

| North Carolina | $65 |

| North Dakota | $65 |

| South Dakota | $65 |

| Vermont | $66 |

| Ohio | $67 |

| New Hampshire | $68 |

| Nebraska | $71 |

| Virginia | $72 |

| Wyoming | $73 |

| Kansas | $73 |

| Hawaii | $73 |

| Minnesota | $73 |

| Tennessee | $74 |

| Utah | $74 |

| Montana | $74 |

| Illinois | $75 |

| Missouri | $75 |

| Alabama | $75 |

| Oregon | $78 |

| Arkansas | $78 |

| Kentucky | $80 |

| New Mexico | $80 |

| Washington | $82 |

| Pennsylvania | $82 |

| California | $84 |

| South Carolina | $84 |

| Mississippi | $84 |

| Arizona | $84 |

| Oklahoma | $85 |

| Colorado | $85 |

| Countrywide | $86 |

| West Virginia | $87 |

| Alaska | $89 |

| Georgia | $91 |

| Texas | $95 |

| Nevada | $95 |

| Massachusetts | $95 |

| Maryland | $95 |

| Connecticut | $99 |

| Delaware | $104 |

| Florida | $108 |

| Rhode Island | $111 |

| District of Columbia | $114 |

| New York | $115 |

| Michigan | $116 |

| New Jersey | $117 |

| Louisiana | $121 |

The cheapest full coverage auto insurance is found in Idaho, Iowa, and Maine. However, the most expensive states for full coverage auto insurance are Michigan, Louisiana, and New Jersey.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Best Full Coverage Auto Insurance Companies

The best full coverage auto insurance company is the company that meets your needs. If your needs happen to align with a company that offers cheap full coverage auto insurance quotes online, then this is a section you may want to pay close attention to.

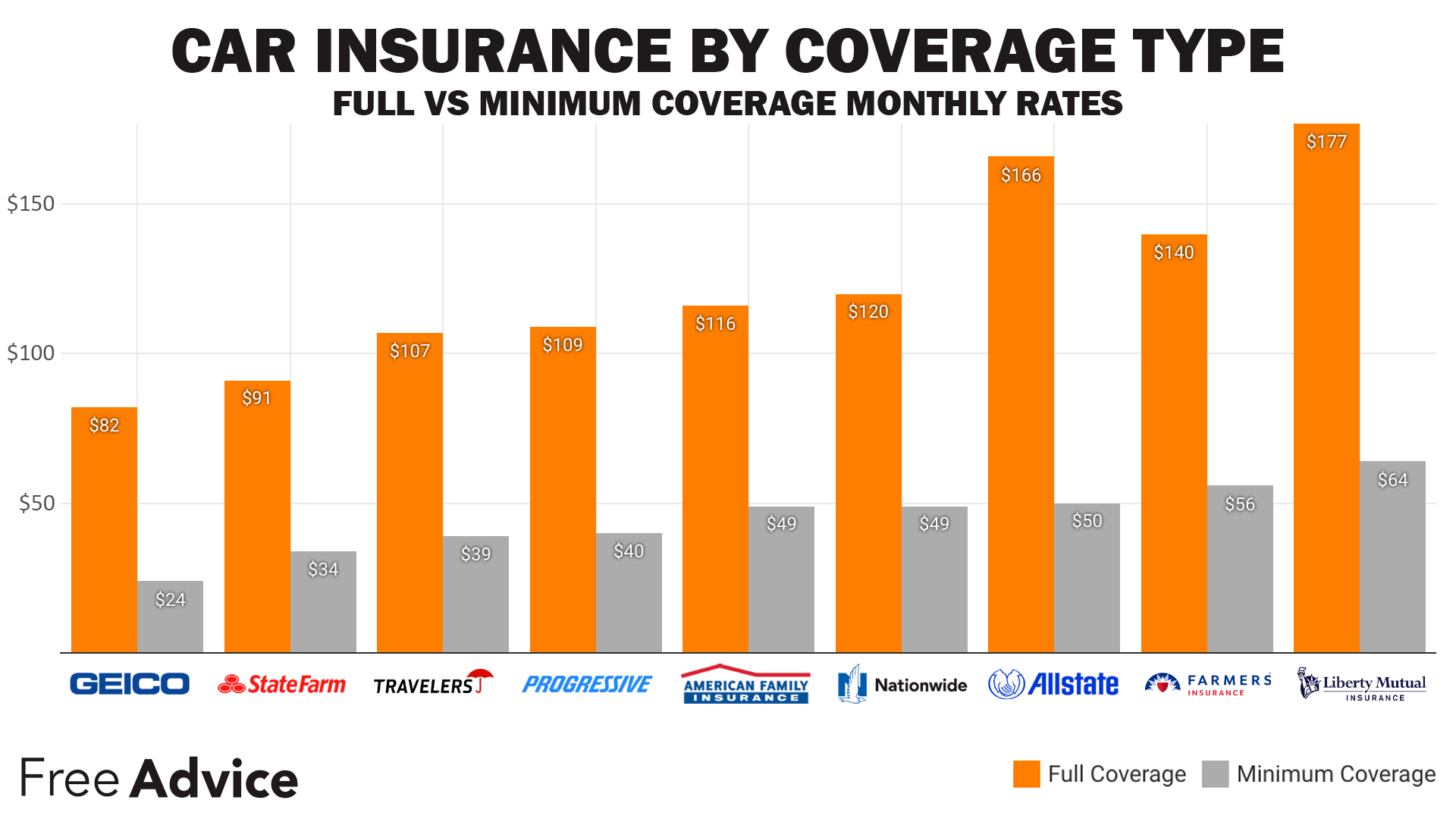

United Services Automobile Association (USAA), State Farm insurance, and Geico full coverage auto insurance rates for young drivers, married drivers, and senior drivers are the cheapest. However, USAA is only available to veterans and their immediate families. Geico full coverage auto insurance costs $80 monthly, almost $40 cheaper than the national average.

Read more: Geico Insurance Reviews & Ratings

How to Get Cheap Full Coverage Auto Insurance

You could get low cost auto insurance with driver discounts if you’re looking for affordable full coverage. Check out this list of discounts that can lower your full coverage auto insurance per month:

- Multi-policy discount

- Anti-theft discount

- Multi-vehicle discount

- Safe driver discount

- Defensive driver discount

- Anti-lock brakes discount

- Telematics insurance coverage

There are other discounts available at your auto insurance company that you can take advantage of, so ask about different ways to save money when you purchase your policy.

Another way you can lower your auto insurance rates is through a good and excellent credit score. According to Experian, there’s a correlation between credit history and risk. Therefore, poor and fair credit holders have higher rates because their credit scores correlate to high risk.

Case Studies: Full Coverage Auto Insurance

Case Study 1: John’s Experience With Liability Auto Insurance

John, a resident of California, was involved in a car accident where he was at fault. Fortunately, he had liability auto insurance as part of his full coverage policy. The liability coverage helped him cover the medical expenses of the injured party and the repair costs for the other driver’s vehicle. Without liability insurance, John would have been personally responsible for these expenses, which could have been financially devastating.

Case Study 2: Sarah’s Collision Auto Insurance Claim

Sarah recently purchased a new luxury car and opted for full coverage auto insurance, including collision coverage. One day, while driving in heavy traffic, Sarah accidentally rear-ended the car in front of her. The collision caused significant damage to both vehicles. Sarah’s insurance company covered the repair costs for her vehicle, ensuring she didn’t have to bear the financial burden on her own.

Case Study 3: Michael’s Comprehensive Auto Insurance Protection

Michael parked his car on the street overnight, only to wake up the next morning and find it vandalized. The windows were shattered, and the stereo system was stolen. Luckily, Michael had comprehensive auto insurance as part of his full coverage policy. The comprehensive coverage allowed him to file a claim and receive compensation for the damages and stolen items.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

The Final Word on Full Coverage Auto Insurance

Understanding your auto insurance policy is one of the essentials you’ll need to learn once you have auto insurance. Don’t get pulled into the full coverage vs. comprehensive and collision argument. They’re both the same thing.

They provide overall auto insurance coverage that ensures you can pay for bodily injury and property damage when you’re at fault and for damage to your vehicle regardless of fault.

Start comparing full coverage auto insurance rates in your area by using our FREE comparison tool below.

Frequently Asked Questions

What is the difference between full coverage insurance and comprehensive insurance?

Full coverage auto insurance covers accidental damage, minimum auto insurance requirements, and collision coverage, but comprehensive auto insurance only covers accidental damage unrelated to collisions.

How much is full coverage insurance a month?

Full coverage auto insurance averages $119 monthly. However, rates vary based on model, driving profile, and demographics, so compare full coverage auto insurance costs to find the right policy for you.

Do I need full coverage insurance on a financed or used car?

Yes. All lenders require drivers to have full coverage auto insurance, even for a used vehicle. Used cars that you own won’t need full coverage, but it’s in your best interest to carry full coverage if you drive it every day.

Do I need full coverage auto insurance on a new car?

New cars are likely financed or carry an expensive fair market value. You’ll need full coverage auto insurance on your new car if it’s financed, but even if it’s not, it’s a good idea. Find cheap full coverage insurance on a new car by shopping around.

How does full coverage insurance work if car is totaled?

Full coverage auto insurance works by adding extra vehicle protection to your liability coverage options. Full coverage activates when your vehicle gets damaged or totaled in an at-fault accident. You can always find the best full coverage auto insurance rates by shopping around with several companies.

What does full auto insurance coverage include?

Full coverage includes collision and comprehensive insurance in addition to state-required liability insurance.

Is it better to have a $500 or $1,000 auto insurance deductible?

A $1,000 deductible will lower your monthly full coverage auto insurance costs, but you will have to pay $1,000 out of pocket after an accident. If you can’t afford to pay this out of pocket, you should choose a lower deductible.

Free Insurance Quote Comparison

Enter your ZIP code below to compare cheap insurance rates.

Secured with SHA-256 Encryption

Editorial Guidelines: We are a free online resource for anyone interested in learning more about legal topics and insurance. Our goal is to be an objective, third-party resource for everything legal and insurance related. We update our site regularly, and all content is reviewed by experts.